Creating a Thanksgiving Budget

As we approach the season of giving thanks, it’s no secret that Thanksgiving has earned a reputation as a holiday of indulgence. According to the American Farm Bureau Federation, the average cost of a Thanksgiving dinner for ten is $70. While a lavish spread is undeniably tempting, it’s essential to remember that Thanksgiving is ultimately about gratitude and the warmth of family and friends. Creating a Thanksgiving budget will allow for a memorable time together without financial stress!

In this post, we’ll explore the art of creating a Thanksgiving budget. While it’s true that costs can quickly add up during the holiday season, a well-planned budget can help you savor the joy of Thanksgiving without the looming shadow of financial stress. I’ll provide practical tips and strategies for creating a meaningful and memorable Thanksgiving that won’t strain your wallet.

Today, I’ll share how to set a budget, craft a delicious menu, and shop smart without breaking the bank. Let’s make this Thanksgiving a testament to gratitude, resourcefulness, and the sheer delight of a well-planned, budget-friendly holiday.

If you’re new to my blog, welcome! My name is Michaela, and I started this blog to share my journey as a homeschooling mom of six, including our son, who was diagnosed with cancer at the age of 4. I write about our favorite recipes, non-toxic swaps, encouragement for moms, and more. If you’re interested in learning more, here are some of my recent posts:

The Most Toxic Products in Your Home and How to Replace Them

Today, I’ll share some tips to keep you on budget while allowing for a festive holiday you’ll remember!

Here are some topics we’ll cover:

Why creating a Thanksgiving budget is important

Creating a Thanksgiving budget

Setting a realistic spending limit

Budget-friendly thanksgiving menu

Potluck style meal

Why creating a Thanksgiving budget is important

Knowing what you can afford and what you’re willing to spend is the first step to creating a Thanksgiving budget. It can be tempting to splurge and go all out, but if you can create a beautiful celebration without going overboard, why not? A well-planned budget can help reduce financial stress and make the holiday more enjoyable. Knowing Christmas is right around the corner, budgeting for Thanksgiving helps relieve the burden of worrying about finances and unnecessary spending. This allows us to focus on the day and spend time with our families.

Creating a Thanksgiving budget

As a large family, our grocery budget is stretched thin. Similar to our bi-weekly grocery budget, spending extra for a holiday is something we plan for in advance so it doesn’t hit our bottom line and leave us scrambling. Planning this way helps me create a monthly savings goal and know how much to put away each month. As a thank you from my husband’s job, we also receive a free turkey every November. This dramatically cuts back on how much we plan to spend on our holiday dinner.

When creating a Thanksgiving budget, consider how many people you will be hosting, if other family members will be bringing side dishes, and planning for potential sales around the holiday.

Our household alone is 8 people. In addition to our family, 2 of my brothers and my sister have families, and my mom, her husband, and 3 of my young sisters will attend our Thanksgiving meal this year, totaling 21 people. Dividing responsibilities between the different households has drastically reduced our overall cost as well as cut back on prep time.

Setting a realistic spending limit

Whatever your goal is for spending, make sure that it’s realistic. Creating a Thanksgiving budget is possible, but there’s no need to make it any more stressful than it sometimes becomes.

If your budget is $10 per person, this provides a little padding to the national average and gives you a savings goal to achieve. If I was responsible for providing the entire meal, and my spending limit was $210, I would take this number and divide it by 12, and this would give me my monthly savings goal. (About $18 per month. I would round up to $20 per month to allow for wiggle room for a total spending limit of $240). This prevents any potential financial stress and allows the holiday to be an enjoyable event. Money is a touchy subject, and when that stressor is removed, staying present and enjoying the meal is easier!

As much as I love meal planning, that can be a bit difficult for a holiday meal. Here are a few tips I use for holiday celebrations:

Shop sales.

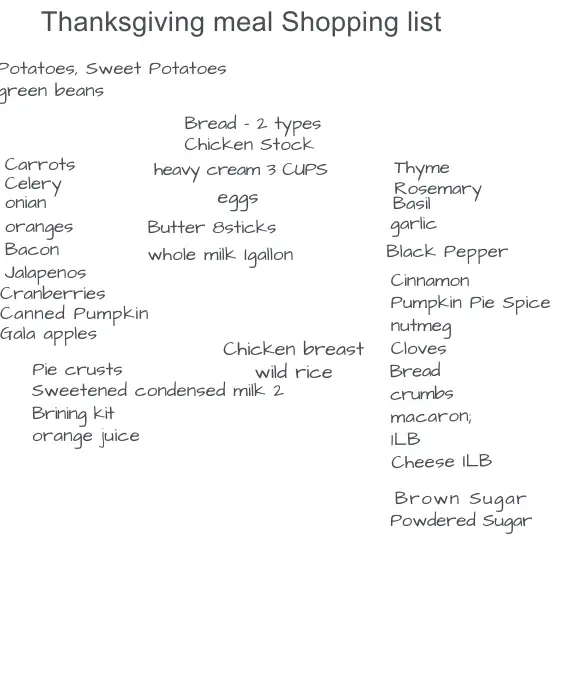

I do this every time I grocery shop, but especially around holiday meals, some stores around me will do a gift card incentive or discount on items commonly used for holiday meals. I always start by listing every item I need for the meal and then look over weekly ads for Target, King Soopers, Walmart, and Costco. Walmart is often the most affordable option, but around holidays, target often does 2 for $5 deals on items like cranberries, chicken stock, and certain veggies.

Compare prices between at least 2 stores.

I go the extra mile and compare the 4 stores closest to my home because every penny counts when you’re making a large meal! Our budget for 2 weeks of meals and snacks is $400, so spending about half of that on one meal is tough. Being a good steward of our money is important, and spending extra time researching prices is always worth it. If I can save $15-$20 by comparing prices and stopping at 2 stores, that’s excellent!

Compare fresh vs. frozen or dried.

I always prefer fresh foods. There’s no comparing. But, when trying to save money and serve a large group of family or friends, using frozen veggies or dried herbs over fresh may help in the long run. We use sage, thyme, oregano, garlic, and a few other herbs heavily in some of the dishes for Thanksgiving. If buying dried herbs will save me money while still offering a great taste, that’s wonderful.

Buy store brand if possible.

We purchase about 80% organic foods when grocery shopping for our home. When hosting a larger meal, we compare the price of conventional products vs organic and consider what to do. If the difference is minimal, we will choose organic as much as possible, but if there is a considerable difference in price, choosing conventional foods is a way to save money. Not everyone is concerned with purchasing organic products, so we don’t feel bad about purchasing conventional foods if the family and friends we’re hosting aren’t worried about it either.

Budget-friendly Thanksgiving menu

Our menu is pretty basic, but this helps us save money while providing a delicious meal. Many dishes have repeat ingredients, which helps when planning my shopping trip.

Many dishes are either recipes I’ve created or simple enough that there is no recipe. If a dish has a link, this is the recipe I use!

Mashed potatoes

Gravy

Dinner rolls

Orange Brined turkey– This recipe does not call for oranges, but we have found it to be the most incredible addition to the recipe to juice 5-6 oranges and add the juice and peels to the brine.

Maple roasted carrots

Roasted green beans

Stuffing

Mac n cheese

Pumpkin pie

Apple pie

Potluck style meal

Hosting a potluck-style meal is an excellent way to reduce cooking time, save money, and enjoy a family holiday. We have always celebrated Thanksgiving this way, and we love celebrating the holiday without the pressure and responsibility of providing the entire meal. Coordinate side dishes, desserts, the turkey, and drinks, dividing them between adults evenly so everyone has similar responsibilities for the meal.

Final thoughts

Thanksgiving is a time to be with loved ones, celebrate what we are grateful for, and start the holiday season on an exciting note. Creating a Thanksgiving budget can help relieve stress, show you how much to save each month, and prepare you for the festive season without worrying about how to pay for the holiday meal. When creating your budget, allow for unforeseen circumstances such as extra family members or large eaters.

Thank you so much for being here today! If this post was helpful to you, please remember to pin it to your favorite board on Pinterest!

This site may contain links to affiliate websites including Amazon. I may receive an affiliate commission for any purchases made by you through Amazon or other potential affiliates and no additional cost to you. Thank you for your support.